– you can adjust those using the green triangles at right. If you wish to see what effect changing any of the basic values would have – varying the loan amount, interest rate, length, etc. The calculator will take all this into account and will calculate your bi-weekly payment amount, your total interest savings and how much faster you will pay off your auto loan. You can also enter a monthly prepayment amount if you wish to make any additional regular payments to pay the loan off even faster. Begin by entering your anticipated date of your first payment, the loan amount, interest rate and length of the loan in months. This calculator is pretty straightforward. Using the Bi-weekly Payments for an Auto Loan Calculator

PAY EXTRAON CAR LOAN CALC FREE

Making payments every other week and being prepared for that occasional extra payment can be good financial discipline and eventually free up your money for other purposes. Others can use the bi-weekly payment approach as well. These people get the equivalent of an extra paycheck a year, compared to their monthly bills, so the every-other-week cycle can work out very well for them.

So this setup tends to work best for people who get paid every other week, rather than once or twice a month. Of course, making the equivalent of 13 monthly payments a year means you have to come up with the cash to make that extra annual payment. The calculator will show you just how quickly, depending on your loan amount, interest rate and length of the loan. By paying down your loan more quickly, you'll also pay less interest – which will help pay off your loan even faster. This doesn't mean you'll simply lop off one month from your auto loan every year. So you're basically making an extra monthly payment each year. Your savings primarily come from the fact that paying every other week means you'll be making 26 half-payments a year – the equivalent of 13 monthly payments. Bi-weekly Payments for an Auto Loan Calculator Overview With the biweekly program 1/2 of this amount will be debited every two weeks. If you are also prepaying, please include your monthly prepayment amount. An additional payment is strictly optional. Prepayment increases your savings even more. Click the view report button to see all of your results.

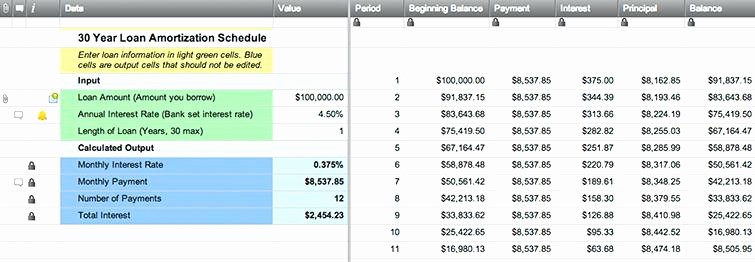

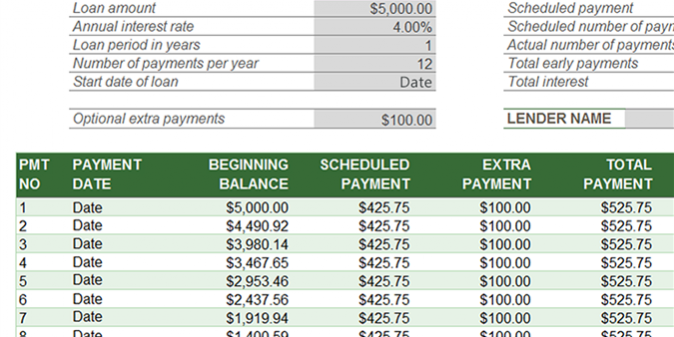

It'll also provide you with an amortization table so you can see just how quickly you'll pay down the loan and what your remaining balance will be at any given time.īy changing any value in the following form fields, calculated values are immediately provided for displayed output values. This Bi-weekly Payments for an Auto Loan Calculator will figure out just how much you can save and how much faster you can pay off your car loan by going to a bi-weekly schedule, and provide you with your bi-weekly payment as well. You simply make a payment every other week rather than once a month and the bank credits it to your loan. Most auto lenders allow you to do this without penalty or requiring any special approval or restructuring the loan. Making a payment every other week, rather than once a month, can let you pay off your loan faster and save money on interest in the process. Looking to save money on a car loan? You might consider making bi-weekly payments. ICB Solutions | NMLS #491986 ( Close Modalīi-weekly Payments for an Auto Loan Calculator Mortgage products are not offered directly on the website and if you are connected to a lender through, specific terms and conditions from that lender will apply. will not charge, seek or accept fees of any kind from you. By submitting your information you agree Mortgage Research Center can provide your information to one of these companies, who will then contact you.

PAY EXTRAON CAR LOAN CALC FULL

For a full list of these companies click here. If you submit your information on this site, one or more of these companies will contact you with additional information regarding your request. ICB Solutions and Mortgage Research Center receive compensation for providing marketing services to a select group of companies involved in helping consumers find, buy or refinance homes. Neither, Mortgage Research Center nor ICB Solutions are endorsed by, sponsored by or affiliated with any government agency. ICB Solutions partners with a private company, Mortgage Research Center, LLC, (nmls # 1907), that provides mortgage information and connects homebuyers with lenders. is a product of ICB Solutions, a division of Neighbors Bank.

0 kommentar(er)

0 kommentar(er)